Sustainable Corporate Governance: more carrots and less sticks

CEC European Managers welcomes the EU’s new Sustainable Corporate Governance initiative. In its reply to the European Commission’s consultation, CEC underlines the urgent need to not only create legal and fiscal incentives, but also to support a future-fit leadership culture and practice. The transition to a net-zero economy requires excellence in European leadership fostered through training, experimental sandboxes, as well as awareness-raising. As CEC’s “Sustainable Leadership in Europe” study shows, a vast majority of EU managers is currently not in the position to execute materiality assessments or stakeholder analysis – without even talking about the quality of such exercises.

As a follow-up to the European Green Deal, the Commission has announced a Sustainable Corporate Governance initiative for 2021. The initiative was listed among the deliverables of the Action Plan on a Circular Economy, the Biodiversity strategy and the Farm to Fork strategy. The Commission had previously introduced legislation on non-financial reporting (NFRD), as well as regulation on sustainability risks disclosure. While these create incentives “to report”, the Sustainable Corporate Governance initiative aims to introduce duties “to do”. Examples for the latter include corporate bonuses or conducting stakeholder impact analysis.

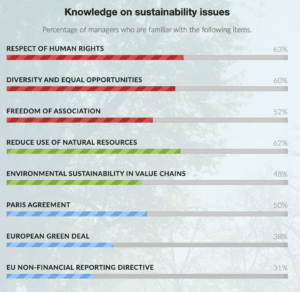

Only a minority of managers knows sustainability frameworks and even fewer relevant EU policies / Pastore 2020: Sustainable Leadership in Europe

While reporting and creating incentives to act sustainably are necessary to create a more favourable level playing field, it seems of utmost importance to also consider the leadership dimension of the green and fair transition. Besides the need “to report” and “to do” the EU needs the shared “vision to” and “capacity to” change its economic model. These are leadership challenges. To ensure creating a sustainable EU economy, managers have to become an active part of the solution towards greener and fairer business models. Otherwise, the legislative obligations will become yet another tick-boxing exercise that misses the opportunity for transformational change of EU industry, leadership culture and improvement on the Triple Bottom Line.

CEC European Managers advocates for a stakeholder model, for social dialogue and a long-term orientation in the definition of management. Many Sustainable Corporate Governance elements, like the duty of care, shall, whenever possible, be defined by social dialogue bodies and only in the absence thereof, by government. For those companies with an unsustainable managerial ethos, these obligations could incentivize a change in approach. Without a change in values and transition skills, these efforts will however not lead far. As our Sustainable Leadership Project shows, we need, above all, to work on values, skills, behaviours and knowledge needed to succeed in this historic transformation process.

Background: evidence on short-termism in European management

The European Commission has commanded a study on directors’ duties and sustainable corporate governance to analyse the integration of sustainability in their activities. It found that sustainability is too often overlooked by short-term financial motives. To some extent, the authors argue “corporate short-termism finds its root causes in regulatory frameworks and market practices.” Furthermore, “data indicate an upward trend in shareholder pay-outs, which increased from 20% to 60% of net income while the ratio of investment (capital expenditure) and R&D spending to net income has declined by 45% and 38% respectively.” As regards due diligence, an EU study on that subject found only one in three large businesses claim to undertake due diligence which takes into account all human rights and environmental impacts. Despite that low number, 70% of EU businesses agreed that EU regulation might provide benefits for business, including legal certainty, level playing field and protection in case of litigation.

To develop more sustainable corporate practices, the Commissions follows three objectives through future legislative action:

- strengthening the role of directors in pursuing their company’s long-term interest by dispelling current misconceptions in relation to their duties, which lead them to prioritise short-term financial performance over the long-term interest of the company;

- improving directors’ accountability towards integrating sustainability into corporate strategy and decision-making;

- promoting corporate governance practices that contribute to company sustainability, by addressing relevant unfavourable practices (e.g. in the area of board remuneration, board composition, stakeholder involvement

Please find our response to the consultation below: